- Rolling over retirement plan assets into a USAA IRA provides tax benefits and investment flexibility, but it is important to consider potential fees and restrictions.

- USAA IRA accounts have no annual fees and offer convenient account management, but they may have higher commissions for mutual funds.

- USAA offers a range of IRA options and tools, but it is worth exploring other brokerage firms for lower fees and more diverse investment options.

Related Post:

Introduction: USAA IRA

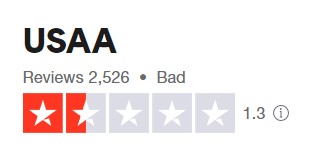

1.3/5 Ratings

When it comes to retirement planning, USAA employees have a valuable option to explore – USAA IRA. In this review, we will delve into the benefits of rolling over retirement plan assets into an IRA, important considerations for USAA employees, and why consulting a financial advisor is crucial for personalized advice. Stay tuned to discover the practical insights and strategic advantages that USAA IRA offers for those planning their golden years.

Pros and Cons

Pros

✅ Growth potential

✅ Principal defense

✅ Tax obligation deferral

✅ Income potential

Cons

❎Variable returns

❎ Liquidity

❎ Surrender charges

❎ Tax obligation penalty

❎ Insurance company danger

Overview of USAA IRA

When it comes to retirement planning, USAA employees have a valuable option to explore – USAA IRA. In this review, we will delve into the benefits of rolling over retirement plan assets into an IRA, important considerations for USAA employees, and why consulting a financial advisor is crucial for personalized advice. Stay tuned to discover the practical insights and strategic advantages that USAA IRA offers for those planning their golden years.

Important Considerations for USAA Employees

USAA employees should think about several important factors when planning for retirement. These include internal management fees, loan restrictions, and early distribution penalties. An IRA may also provide protection against creditors, while potentially preserving tax treatment. A financial advisor can provide individualized advice.

Rolling over assets into an IRA can have its drawbacks. There can be higher fees, and fewer investment choices. But, there’s also convenience with combined statements and holistic investment planning. Weigh the pros and cons before deciding.

Remember, loans from an IRA may be restricted, leading to early distribution penalties. There is extra protection against creditors, and possible tax treatment with an IRA. Know the facts to make an informed decision about retirement planning.

Be aware that internal management of retirement funds could cost more.

Their retirement planning tools and IRA account management features are user-friendly, but their tools and resources are average to slightly below-average in comparison.

The Benefits of Rolling Over Retirement Plan Assets into an IRA

Rolling over retirement plan assets into an IRA offers various benefits – from tax-deferred growth potential and more investment choices to the convenience of combined statements and thorough investment planning. However, it is essential to consider drawbacks too, such as higher internal management fees, restrictions on IRA loans, and early distribution penalties. Plus, an IRA provides extra protection against creditors and preserves tax treatment. For personalized advice, consult a financial advisor – they can provide further help based on your personal circumstances and goals.

Highlight the benefits that come with an IRA:

• Tax-Deferred Growth Potential: Rolling over retirement plan assets into an IRA allows you to benefit from tax-deferred growth potential, which can maximize long-term return on investment.

• More Investment Choices: An IRA gives you access to a wider range of investment options than employer-sponsored retirement plans.

• Convenience of Combined Statements: Consolidating retirement plan assets into one IRA account simplifies financial management by providing a single comprehensive statement.

• Holistic Investment Planning: Rolling over retirement plan assets into an IRA can help you develop a comprehensive investment strategy that aligns with your financial goals.

• Additional Protection Against Creditors: IRAs offer protection against creditors and potential legal actions that could endanger retirement savings.

It’s also important to be aware of potential drawbacks associated with IRAs, like higher internal management fees and restrictions on loans that can lead to early distribution penalties if not repaid in time. Plus, rolling over retirement plan assets into an IRA ensures tax treatment advantages granted by the IRS.

Take for instance John, who was able to enhance his retirement savings by rolling over his 401(k) into an IRA. This gave him access to a wider range of investment choices and the convenience of combined statements. Moreover, John found comfort in the fact that his retirement assets were safeguarded against potential creditors. Overall, rolling over his retirement plan assets into an IRA proved to be a great decision for his long-term financial security.

Tax-Deferred Growth Potential and More Investment Choices

Rolling over retirement plan assets into an IRA has its perks! Tax-deferred growth potential and a wider range of investments can help individuals reach their financial goals. With an IRA, statements are combined, making financial management easier. USAA employees should be aware of higher internal management fees, however. Also, loans from an IRA are generally not allowed, and early distributions may incur penalties and taxes. Ultimately, it’s best to consult a financial advisor for personalized advice. Enjoy the added protection and peace of mind with USAA IRA’s!

Convenience of Combined Statements and Holistic Investment Planning

USAA IRAs provide the convenience of combined statements and holistic investment planning for individuals managing their retirement plan assets. This includes tax-deferred growth, more investment choices, simplified account management, and a comprehensive financial overview. Streamlined recordkeeping and integrated advice and guidance let individuals take control of their investments. However, there are potential higher fees and restrictions on loans from an IRA to be aware of.

Potentially Higher Internal Management Fees

USAA IRA accounts have the possibility of higher internal management fees than other options. No annual fees, custodial fees, account maintenance fees, or inactivity fees are connected to USAA IRAs. It’s crucial to be aware of this potential. That means investors could experience greater costs for managing their IRA investments on the USAA platform.

When selecting if USAA is the correct decision for your IRA, these possibly higher internal management fees should be thought of carefully. USAA provides a simple website, automated investing, and great customer service. But, investors must decide if the advantages of these qualities outdo the possible consequences of higher internal management fees. Analyzing the costs and features of USAA IRA accounts with other brokerage firms is recommended before making a choice.

Moreover, active traders should know that USAA could be unsuitable for them due to its high commissions on mutual funds. Frequent buyers and sellers of mutual funds may find these commissions significantly reduce their overall returns. So, those who engage in frequent trading activities may want to look into other alternatives that offer lower fees and more adaptable trading possibilities.

Restrictions on Loans from an IRA and Early Distribution Penalties

Jane, a USAA employee, looked into taking a loan from her IRA. But, she discovered that loans are not allowed. If she took out funds before the age of 59½, she could face IRS penalties.

These restrictions exist to protect retirement savings and discourage non-retirement uses. Though it can be seen as a drawback, these limits aid in long-term financial security.

Exceptions to the early distribution penalties exist, such as for qualified education expenses or a first home. To understand the rules and consequences of withdrawals, Jane consulted a financial advisor.

In the end, Jane found alternate ways to cover her medical expenses without sacrificing her retirement plans.

Additional Protection Against Creditors and Loss of Tax Treatment

The USAA IRA offers additional protection from creditors, as well as benefits with regards to tax treatment of assets. This means individuals keeping assets in the IRA are safeguarded from any future claims. Moreover, contributions to an IRA are tax-deductible and any investment gains within it are tax-deferred.

It’s important to note that while this type of account offers protections and potential tax advantages, there are restrictions and penalties associated too. For instance, taking out loans from the IRA without paying a fee or withdrawing funds before a certain age can lead to penalties.

For those looking for more diverse investment options, Vanguard and Fidelity can offer a better range of funds and lower fees. It is advised to consult a financial advisor to get tailored advice on retirement planning.

Investors can diversify their portfolio by investing in different types of gold bars. By considering their financial goals, risk tolerance, and investment objectives, they can maximize returns while minimizing risk.

USAA IRA Fees: Comparing Costs and Features

When it comes to USAA IRA fees, it’s important to compare costs and features to make informed decisions. In this section, we’ll explore the different aspects of USAA IRA fees, including fees related to account maintenance, custodial fees, inactivity fees, and annual fees. Additionally, we’ll delve into the commissions for stocks, ETFs, and options and how they compare to other brokers. Let’s break down the costs and features to help you understand the value of USAA IRA.

Exploring USAA IRA Options and Tools

Discover the diverse range of USAA IRA options and tools that can help you secure your financial future. Delve into the USAA Mutual Funds Account, Brokerage Account, USAA Bank CD, Managed Portfolios, Annuities, Retirement Planning Tools, and IRA Account Management to make informed decisions for your retirement. Uncover the benefits of each option and explore how these tools can optimize your IRA experience. Get ready to navigate the world of USAA IRAs with confidence and clarity.

USAA Mutual Funds Account, Brokerage Account, USAA Bank CD, Managed Portfolios, and Annuities

USAA offers multiple investment options to customers. These include:

• The Mutual Funds Account, which lets investors purchase shares of USAA-managed mutual funds.

• The Brokerage Account, which offers a wider range of investments and research tools for those who seek flexibility.

• The USAA Bank CD, which is a safe way to earn interest on deposits.

• Managed Portfolios, which are suitable for those who want professional management of their investments.

• Annuities, which provide regular income payments.

It’s important to note that while USAA may be a good option, there could be better alternatives with lower fees or more diverse fund options.

USAA provides customers with various ways to build and manage their portfolios. Plus, they have retirement planning tools and IRA account management to make retirement stress-free.

Retirement Planning Tools and IRA Account Management

USAA provides retirement planning tools and IRA account management resources. These enable individuals to maximize savings and efficiently manage their retirement accounts. Their user-friendly website has various sections. These include positions, activity, balances, order status, quotes, and trading. With these tools, investors can easily track their investments and make informed decisions.

The resources from USAA are average to slightly below-average. They are designed to help people with their retirement planning strategies. Although they are not as comprehensive as other brokerage firms, they still offer valuable insights.

USAA also provides personal advice through a network of financial advisors. They can provide guidance based on an individual’s specific retirement goals. This customized service sets USAA apart from other providers. By consulting with a financial advisor, people can ensure they make the best decisions about their IRA account management.

USAA’s retirement planning tools and IRA account management have several benefits. These include easy navigation, comprehensive tracking, and expert advice. Other options may be better depending on fees or tool offerings. However, USAA remains a reliable choice for those searching for IRA account management solutions.

User-Friendly Website with Sections for Positions, Activity, Balances, Order Status, Quotes, and Trading

USAA IRA Final Thought

USAA may be a good fit for some investors, but there are better alternatives. They have no annual fees or account maintenance fees for their IRA accounts. However, their commissions for mutual funds are higher compared to other brokers. Their tools and resources are average, with limited portfolio analysis. Investors who value more funds and lower fees may prefer Vanguard, Fidelity, or Charles Schwab. All in all, USAA can work for some, but there are better choices.

Some Facts About USAA IRA Review:

✅ USAA offers IRA accounts with no annual fees. (Source: USAA IRA Fees)

✅ USAA charges a $35 fee to close an IRA account. (Source: USAA IRA Fees)

✅ USAA offers a variety of investment options, including mutual funds, ETFs, and fixed income investments. (Source: USAA IRA Review)

✅ USAA’s research and educational resources are rated as average to slightly below-average. (Source: USAA IRA Review)

✅ USAA is a solid choice for novice investors and those looking for a robo-advisory or managed portfolio option. (Source: USAA IRA Review)

FAQs About USAA IRA Review

What are the commission charges for options in a USAA IRA account?

USAA charges commissions of $45 for options in an IRA account.

Does USAA offer home insurance along with IRA accounts?

Yes, USAA is one of the largest providers of auto and home insurance and also offers IRA accounts.

Can retired military members and their spouses open an IRA account with USAA?

Yes, USAA IRA accounts are available to retired military members and their spouses.

What is the mission statement of USAA?

USAA’s mission is to serve those who serve, specifically military members and their families.

Can family members who are not military members open an IRA account with USAA?

No, USAA IRA accounts are limited to military members and their families only.

Does USAA provide online chat support for IRA account holders?

Yes, USAA offers online chat support as one of their customer service options for IRA account holders.