4.5/5 Ratings

Colonial Metals Group garnered attention in the investment sphere for its offerings in precious metals, catering to individuals seeking to diversify their portfolios or safeguard against economic uncertainties. In this review, we’ll look into the pros and cons of Colonial Metals Group, aiming to provide clarity on its legitimacy and efficacy as a trusted partner in the realm of precious metal investments. By analyzing customer feedback, market reputation, and key features, we aim to equip readers with valuable insights to make informed decisions regarding their investment strategies.

Pros and Cons

Pros

✅ Diverse portfolio of precious metal options

✅Commitment to customer satisfaction and transparency

✅Strong reputation in the industry

✅Emphasis on regulatory compliance and security

Cons

❎Limited accessibility to pricing and fee information

❎Lack of detailed educational resources for investors

Overview of Metals Group

Colonial Metals Group, a notable player in the precious metals investment arena, offers a diverse portfolio of products tailored to individual investor needs. Whether it’s gold, silver, platinum, or palladium, Colonial Metals Group provides access to a range of precious metal options for investors looking to hedge against market volatility or diversify their portfolios.

With a focus on customer satisfaction and transparency, the company strives to educate clients about the benefits and risks associated with precious metal investments. Its commitment to regulatory compliance and security ensures that customers can trust the integrity of their investments.

However, some customers have raised concerns about accessibility to information, particularly regarding fees and pricing structures.

Colonial Metals Group maintains a solid reputation in the industry, backed by positive feedback and a commitment to service quality.

Is Colonial Metals Group Legit?

Ensuring the legitimacy of Colonial Metals Group is crucial for investors venturing into the realm of precious metal investments. The company’s robust adherence to regulatory compliance, including standards set by regulatory bodies such as the Internal Revenue Service (IRS), provides a strong foundation of legitimacy. Also, Colonial Metals Group’s commitment to transparency, evidenced by clear communication regarding fees, pricing structures, and investment options, further bolsters its credibility. Besides, the company’s positive reputation within the industry, as evidenced by favorable customer reviews and its standing with organizations like the Better Business Bureau (BBB), instills confidence in its legitimacy. However, prospective investors should exercise due diligence, thoroughly reviewing all available information and seeking independent verification, to ensure Colonial Metals Group aligns with their investment objectives and values.

Colonial Metals Group Fees

Colonial Metals Group typically charges a flat rate fee for its services, with costs ranging from $200 to $500 depending on the investment amount and selected products. Also, investors should be aware of potential transaction fees, which can vary based on the type and size of the investment.

While Colonial Metals Group aims to provide transparent fee structures, potential investors are encouraged to review all fee information thoroughly before making any investment decisions to ensure alignment with their financial goals and preferences.

Colonial Metals Group Bonus Offer

Colonial Metals Group occasionally extends bonus offers to investors as part of their promotional strategies. These bonus offers may include incentives such as waived fees, discounted rates, or complementary services.

However, the availability and specifics of these bonus offers can vary depending on market conditions and promotional campaigns run by the company. Prospective investors are encouraged to inquire directly with Colonial Metals Group or check their website for any ongoing bonus offers or promotions.

Colonial Metals Group Offerings

Colonial Metals Group provides a diverse array of investment options tailored to meet the needs of investors seeking exposure to precious metals. Here are some of the key offerings available:

Precious metals IRA

Colonial Metals Group offers individuals the opportunity to invest in a Precious Metals IRA, allowing for the purchase of gold, silver, platinum, and palladium within a tax-advantaged retirement account. This option enables investors to diversify their retirement portfolios and potentially hedge against inflation and market volatility.

Buying physical gold

Investors looking to acquire physical gold can do so through Colonial Metals Group’s platform. The company facilitates the purchase of gold bars and coins, providing investors with tangible assets that can serve as a store of value and a hedge against economic uncertainties.

Buying coins

Colonial Metals Group offers a wide selection of gold and silver coins for investors interested in building a collection or adding numismatic assets to their investment portfolios. These coins come from reputable mints and are available in various denominations, making them accessible to investors with different budgetary constraints.

Buying bullion

For investors seeking exposure to the broader precious metals market, Colonial Metals Group offers the option to purchase bullion. Bullion products, such as gold and silver bars, are valued primarily for their metal content and are often used as a means of preserving wealth and diversifying investment portfolios. With Colonial Metals Group, investors can access high-quality bullion products from trusted sources, ensuring transparency and authenticity in their investments.

Comparing Colonial Metals Group

While looking through precious metals investment companies, it’s essential to weigh the offerings and services of different firms to make an informed decision.

Below, we compare Colonial Metals Group with several prominent players in the industry, highlighting key differences and similarities.

Colonial Metals Group vs Augusta Precious Metals

Colonial Metals Group and Augusta Precious Metals both cater to investors seeking to diversify their portfolios with precious metals. While both companies offer a range of investment options, including gold and silver IRAs, there are notable differences in their approach.

Colonial Metals Group distinguishes itself with a strong emphasis on customer satisfaction and transparency, backed by a solid reputation within the industry. On the other hand, Augusta Precious Metals prides itself on its educational resources and customer service, aiming to empower investors with knowledge to make informed decisions.

Ultimately, the choice between Colonial Metals Group and Augusta Precious Metals may come down to individual preferences regarding service quality and educational support.

Colonial Metals Group vs Goldco

Comparing Colonial Metals Group with Goldco reveals nuanced differences in their respective offerings and client-focused approaches. While both companies specialize in precious metals investments, they vary in their emphasis.

Colonial Metals Group prioritizes regulatory compliance and security, ensuring that clients’ investments are safeguarded against potential risks. In contrast, Goldco emphasizes gold IRAs as a hedge against economic uncertainty and inflation, offering educational resources to help investors understand the benefits of precious metals.

Investors may choose Colonial Metals Group for its commitment to transparency and security, while those seeking specialized expertise in gold IRAs may opt for Goldco.

Colonial Metals Group vs American Hartford Gold

Colonial Metals Group and American Hartford Gold serve as reputable options for investors interested in precious metals investments, yet they diverge in certain aspects.

Colonial Metals Group distinguishes itself with its diverse portfolio of precious metal options and its dedication to customer satisfaction and transparency. Conversely, American Hartford Gold focuses on gold and silver IRAs as a means of preserving wealth and hedging against market volatility, prioritizing client education and support throughout the investment process.

Depending on investor preferences regarding portfolio diversification and educational resources, either Colonial Metals Group or American Hartford Gold may be the preferred choice.

Colonial Metals Group vs Birch Gold Group

When comparing Colonial Metals Group with Birch Gold Group, investors will find differences in their approaches to precious metals investments.

Colonial Metals Group stands out for its commitment to regulatory compliance and security, offering a diverse range of precious metal options for investors seeking portfolio diversification.

Birch Gold Group, on the other hand, specializes in gold and silver IRAs, emphasizing the role of precious metals in protecting against economic uncertainty and inflation. Beyond that, Birch Gold Group provides personalized guidance and educational resources to help investors navigate the complexities of precious metal investments.

Investors may choose Colonial Metals Group for its broader range of precious metal options, while Birch Gold Group may appeal to those seeking specialized expertise in gold and silver IRAs.

Colonial Metals Group vs Lear Capital

Colonial Metals Group and Lear Capital represent two reputable options for investors interested in precious metals investments, each with its unique strengths.

Colonial Metals Group distinguishes itself with its commitment to customer satisfaction and transparency, offering a diverse portfolio of precious metal options and prioritizing regulatory compliance and security.

In contrast, Lear Capital focuses on educating investors about the benefits of precious metals and provides personalized guidance to help clients build resilient investment portfolios.

While Colonial Metals Group appeals to investors seeking a broad range of investment options and transparency, Lear Capital may be preferred by those seeking specialized expertise and educational support in precious metals investments.

How to Open an Account with Colonial Metals Group

Opening an account with Colonial Metals Group is a straightforward process designed to provide investors with easy access to precious metal investments. Below are the steps to guide you through the account opening procedure:

1. Initial Consultation

To begin the process, prospective investors are encouraged to schedule an initial consultation with a Colonial Metals Group representative. During this consultation, investors can discuss their investment goals, risk tolerance, and desired products.

2. Account Application

Following the consultation, investors will be required to complete an account application. This application typically includes personal information such as name, contact details, and investment preferences. Also, investors may need to provide documentation to verify their identity and comply with regulatory requirements.

3. Fund Your Account

Once the account application is approved, investors can fund their account by transferring funds from a bank account or rolling over funds from an existing retirement account, such as a 401(k) or IRA. Colonial Metals Group offers various payment options to accommodate investor preferences.

4. Select Investments

With the account funded, investors can work with a Colonial Metals Group advisor to select suitable investments based on their investment objectives and risk tolerance. The company offers a diverse range of precious metal options, including gold, silver, platinum, and palladium.

5. Review and Confirm

Before finalizing the investment, investors will have the opportunity to review and confirm their selections. Colonial Metals Group encourages investors to carefully review all investment details, including pricing, fees, and potential risks, to ensure alignment with their financial goals.

Our commitment to integrity and accuracy sets us apart as a reliable source of information in the field of precious metals investing.

Why You Should Trust Us: How We Reviewed Colonial Metals Group

At Gold IRA News, our mission is to provide readers with reliable and unbiased information to aid in their decision-making process regarding precious metals investments.

When reviewing Colonial Metals Group, we conducted thorough research and analysis to ensure the accuracy and credibility of our assessment. Here’s how we approached the review:

Comprehensive Research: We gathered information from a variety of sources, including Colonial Metals Group’s website, customer reviews, industry publications, and regulatory filings. By examining multiple perspectives, we aimed to gain a holistic understanding of the company’s offerings and reputation.

Objective Analysis: Our review of Colonial Metals Group was conducted with objectivity and impartiality in mind. We assessed the company’s strengths and weaknesses based on factual evidence and avoided biased language or undue influence from external parties.

Focus on Transparency: Transparency is essential in the precious metals investment industry, and we prioritized companies like Colonial Metals Group that demonstrate a commitment to transparency in their operations. We evaluated factors such as fee transparency, regulatory compliance, and customer communication to gauge the company’s trustworthiness.

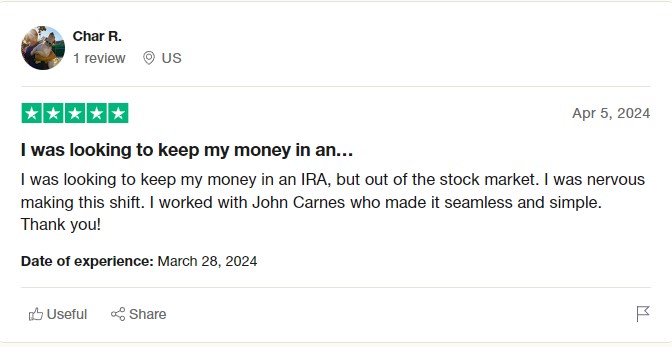

Consideration of Customer Feedback: Customer feedback provides valuable insights into a company’s performance and customer satisfaction. We analyzed reviews and testimonials from Colonial Metals Group clients to understand their experiences and gauge overall satisfaction levels.

Expert Opinion: In addition to our own research, we consulted with industry experts and financial professionals to gather insights and perspectives on Colonial Metals Group’s offerings and reputation. This allowed us to validate our findings and ensure the accuracy of our review.

By following these rigorous review processes, we aim to provide readers with trustworthy and informative content that empowers them to make informed decisions about their precious metals investments.

Alternatives to Gold IRA

While Gold IRAs offer a popular avenue for diversifying retirement portfolios, there are several alternatives to consider that may suit investors’ preferences and financial goals. Below are some alternatives worth exploring:

Silver IRA: Similar to Gold IRAs, Silver IRAs allow investors to hold silver bullion or coins within a tax-advantaged retirement account. Silver offers a more affordable entry point for investors looking to hedge against economic uncertainties and inflation.

Precious Metals ETFs: Exchange-traded funds (ETFs) that track the performance of precious metals such as gold, silver, platinum, and palladium offer a convenient way to gain exposure to these assets without directly owning physical metal. Precious Metals ETFs provide liquidity and can be traded on stock exchanges like individual stocks.

Mining Stocks: Investing in mining stocks of companies engaged in the exploration, extraction, and production of precious metals can offer exposure to the sector’s potential upside. Mining stocks may provide leverage to the price movements of precious metals but also carry additional risks associated with operational performance and industry dynamics.

Real Estate Investment Trusts (REITs): Real estate investment trusts that focus on owning and managing properties related to precious metals production or storage can provide indirect exposure to the sector. REITs offer potential dividend income and may serve as a diversification tool within a broader investment portfolio.

Commodities Futures: Trading commodities futures contracts tied to the prices of precious metals allows investors to speculate on price movements without owning physical metal. Futures contracts offer leverage but also entail significant risks and may not be suitable for all investors.

Alternative Assets: Beyond precious metals, investors may consider alternative assets such as cryptocurrency, art, collectibles, or venture capital investments to diversify their portfolios further. Alternative assets offer unique risk-return profiles and can provide uncorrelated returns to traditional asset classes.

Exploring these alternatives alongside Gold IRAs can help investors tailor their retirement portfolios to their risk tolerance, investment objectives, and market outlook. It’s essential to conduct thorough research and consult with financial advisors to determine the most suitable investment approach based on individual circumstances.

Colonial Metals Final Thought

Colonial Metals Group stands as a reputable player in the realm of precious metals investments, offering a diverse array of products tailored to individual investor needs.

With a focus on customer satisfaction, transparency, and regulatory compliance, the company provides a solid foundation for investors looking to diversify their portfolios or safeguard against economic uncertainties.

While Colonial Metals Group boasts strengths such as a diverse portfolio of precious metal options and a commitment to security, prospective investors should remain diligent in their research and seek independent verification to ensure alignment with their investment goals.

By weighing the pros and cons, exploring alternative investment options, and consulting with financial advisors, investors can make informed decisions to navigate the complex landscape of precious metals investments effectively.

FAQs About Colonial Metals Group IRA Review

1. What is a Precious Metals IRA, and how does it work?

A Precious Metals IRA, also known as a Gold IRA or Silver IRA, is a self-directed individual retirement account that allows investors to hold precious metals such as gold, silver, platinum, and palladium as part of their retirement savings.

With Colonial Metals Group, investors can set up a Precious Metals IRA and purchase eligible metals through the account. These metals are held in a secure depository on behalf of the investor, providing tax advantages and the potential for portfolio diversification.

What are the benefits of investing in a Precious Metals IRA with Colonial Metals Group?

Investing in a Precious Metals IRA with Colonial Metals Group offers several benefits. Firstly, it provides investors with the opportunity to diversify their retirement portfolios beyond traditional assets like stocks and bonds.

Precious metals have historically served as a hedge against inflation and economic downturns, potentially offering stability during times of market volatility. Even more, holding precious metals within an IRA can provide tax advantages, allowing investors to defer taxes on any gains until retirement.

Can I transfer an existing IRA or 401(k) to a Precious Metals IRA with Colonial Metals Group?

Yes, Colonial Metals Group facilitates the transfer or rollover of funds from existing IRAs, 401(k)s, or other eligible retirement accounts into a Precious Metals IRA. This process allows investors to consolidate their retirement savings and gain exposure to precious metals within a tax-advantaged account.

Are there any restrictions on the types of precious metals I can hold in my Colonial Metals Group IRA?

While Colonial Metals Group offers a wide selection of precious metals for IRA investment, investors should be aware of certain restrictions. For example, not all types of gold or silver coins may be eligible for inclusion in an IRA, and certain purity standards must be met.

Colonial Metals Group advisors can provide guidance on eligible metals and help investors navigate any restrictions.

What storage options are available for the precious metals held in my Colonial Metals Group IRA?

Colonial Metals Group works with reputable depositories that offer secure storage facilities for precious metals held in IRA accounts. These depositories are typically insured and regulated, providing peace of mind for investors concerned about the safety and security of their assets.

Investors may choose from various storage options based on their preferences and risk tolerance.

Can I take physical possession of the precious metals held in my Colonial Metals Group IRA?

While investors generally cannot take physical possession of the precious metals held in their IRA accounts without triggering tax consequences, Colonial Metals Group offers options for liquidating or distributing metals from the IRA when needed.

Investors can work with Colonial Metals Group advisors to check these options and make informed decisions regarding their retirement savings.

How often can I make contributions or purchases for my Colonial Metals Group IRA?

Investors can typically make contributions or purchases for their Colonial Metals Group IRA on a recurring basis, depending on their investment strategy and financial circumstances.

Colonial Metals Group advisors can assist investors in establishing a systematic investment plan that aligns with their goals and preferences. At the same time, investors may have the flexibility to make one-time purchases or contributions as needed.