• American IRA is a reputable company specializing in self-directed IRAs, offering a variety of account types and investment options.

• Positive customer reviews commend American IRA for their professionalism, quick responses, and satisfaction with assistance.

• It is important to consider the mixed customer reviews, including negative experiences with customer service and positive experiences with smooth transactions and affordability.

• American IRA provides a range of features and offerings, including different account types and investment options, a knowledgeable CEO and management team, a transparent fee schedule, and reliable customer support.

• When considering precious metals investment, it is advisable to review other options and consider other reviews to make an informed decision.

Related Post:

Precious Metals IRA Rollover to 401K

Universal coin and bullion review

Introduction: American IRA

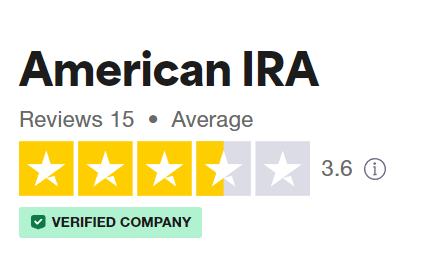

3.6/5 Ratings

American IRA Review provides valuable insights and information about IRA investment options, tips, and strategies. Discover how American IRA can help you in maximizing your retirement savings and securing a financially stable future. Whether you’re a seasoned investor or just getting started, this comprehensive review will cover all the essentials you need to know about American IRA and its offerings. Stay tuned to uncover the key benefits and features that set American IRA apart in the realm of retirement planning.

Pros and Cons

Pros

✅ You may be able to enjoy a tax deduction currently

✅You can delay your tax costs on your earnings

✅Your withdrawals are yours to maintain

✅You do not ever before have to take out anything

✅You can take out contributions penalty-free at any time

Cons

❎There are no ahead of time advantages

❎The simplicity of early withdrawals can be alluring

❎You’re needed to take out the cash

❎You’ll pay tax obligations in the future

❎You’ll probably pay charges for very early access

Overview of American IRA

American IRA is a leading company in the field of self-directed IRAs, offering a wide range of account types and investment options. In this overview, we will explore the background and establishment of American IRA, their specialization in self-directed IRAs, as well as the various account types and investment options they provide to their customers. Additionally, we will take a look at customer reviews and reputation, giving you a comprehensive understanding of American IRA’s services and offerings.

American IRA is renowned for its expertise in self-directed IRAs. Providing valuable investment options, they have earned a good reputation. They offer various accounts and provide a wide range of investment options.

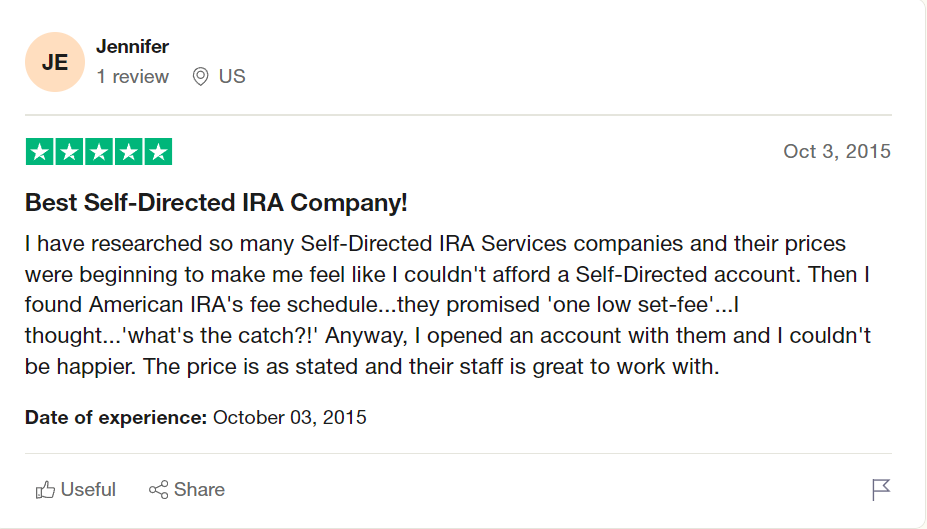

Reviews show customer satisfaction. Praise for the reps’ professionalism and prompt responses is common. These positive experiences highlight American IRA’s success in helping individuals with their IRAs.

Mixed reviews, however, show frustration with customer service. This emphasizes the need for clear communication channels and efficient problem resolution processes.

Features and offerings are diverse and the CEO and management team have good reviews. Transparent fee schedule and reliable customer support are also available.

Background and Establishment

American IRA stands out in the financial industry for its respectable background and establishment. They are experts in self-directed IRAs, providing many account types and investment options. Thanks to their quality service, customer reviews are full of compliments for their professionalism and quick responses. Though some customers have expressed dissatisfaction in their experiences with customer service, many others have praised American IRA’s dedication to excellent customer service. Smooth transactions, helpful assistance, and affordability have been frequently mentioned.

Specialization in self-directed IRAs

American IRA specializes in Self-directed Individual Retirement Accounts (IRAs). They focus on giving individuals control of their retirement savings. The company has become a leader in this niche market. They have a team that knows the individual needs and challenges of self-directed investors.

American IRA goes above and beyond. They provide traditional options like stocks and bonds. Plus, they provide alternative investments like real estate, precious metals, and private placements. This provides individuals with customized portfolios based on their goals and risk tolerance.

Customers praise American IRA for their professionalism, fast response times, and help throughout the investment process. This shows the expertise and support they offer to individuals managing their retirement funds.

American IRA specializes in self-directed IRAs. Their background, investment options, and customer reviews demonstrate their commitment to helping individuals make informed decisions about their retirement savings. If you are looking for account types and investment options, American IRA is the perfect place to go.

Account Types and Investment Options Offered

American IRA is renowned for their commitment to their customers. They offer a variety of account types and investments, including stocks, bonds, mutual funds, real estate, and precious metals. This allows individuals to customize their investments to fit their needs and goals.

The flexibility of American IRA’s account types lets customers tailor their strategies to their financial objectives. And, by offering a wide selection of investments, customers can construct a portfolio that works for them.

One unique trait of American IRA is their expertise in self-directed IRAs. This enables clients to take charge of their retirement savings and invest in alternative assets, granting them more investment opportunities and potentially higher returns.

Customers are delighted with American IRA’s professionalism and fast responses, making them feel appreciated. Positive reviews and a great reputation are proof of their dedication to customer satisfaction.

American IRA stands out from their competitors by providing a wide range of accounts and investments, allowing individuals to reach their financial goals. Their dedication to self-directed IRAs demonstrates their commitment to helping customers maximize their retirement savings. At American IRA, customer opinions are of utmost importance when it comes to securing a prosperous future.

Customer Reviews and Reputation

American IRA has gained a brilliant rep among customers, due to their customer reviews and notoriety. They’ve been applauded for their professionalism, fast replies, and backing.

Consumers have been gratified with their encounters and the level of customer service given by American IRA.

• Randall B and Robert B both gave 5-star reviews, commending the company’s services.

• Stephen R had a pleasant experience, rating them 4-stars.

• Ralph B praised the firm for providing a seamless transaction process.

• Gregg R was astonished with the professionalism exhibited by American IRA.

Despite a few bad experiences with customer service, e.g. response delays or difficulty getting in touch with representatives, American IRA has kept a good rep among consumers. Many customers appreciate the accessibility and simplicity of transactions offered by American IRA. It’s vital for customers to be able to contact a real person when they need help.

American IRA has earned a solid rep based on positive customer reviews and reputation. Although there have been some grievances about customer service, generally customers have applauded the professionalism and responsiveness of the firm. The affordability and ease of transactions offered by American IRA have also been lauded as great features of their services.

American IRA’s Features and Offerings

American IRA offers a range of features and offerings that cater to investors’ needs. From various account types and investment options to a strong management team, they provide comprehensive services. Their fee schedule and customer support are noteworthy, ensuring a seamless experience for clients. In comparison to E*TRADE and other competitors, American IRA stands out for its distinct advantages. Keep reading to learn more about what sets them apart in the investment landscape.

Account types and investment options available

American IRA is a specialist in self-directed IRAs, offering a variety of account types & investment options. These include: Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs & individual 401(k) plans.

Within these accounts, investors can select from stocks, bonds, mutual funds, real estate, private placements, precious metals & more.

For additional diversity, American IRA provides alternative assets like gold & silver. This allows individuals to diversify their retirement portfolios beyond traditional investments.

Positive customer reviews illustrate the importance of the account types & investment options offered. Customers have expressed satisfaction with American IRA’s ability to meet their specific preferences. This shows that American IRA understands the importance of offering a wide range of investment options to suit each client’s needs.

It’s essential to compare American IRA to competitors like E*TRADE before investing. Consider their account types, investment options, management team, fee schedule, and customer support. Then you can decide which option is best for your precious metals investments.

Mixed Customer Reviews

Mixed Customer Reviews at American IRA reveal both negative and positive experiences, covering issues with customer service, seamless transactions, affordability, and the importance of speaking to a person when contacting the company. With varying perspectives, these reviews shed light on the overall customer satisfaction and highlight important factors to consider when engaging with American IRA.

Negative Experiences with Customer Service

The customer service at American IRA has caused some customers to worry. Reviews point to issues such as a lack of response and difficulty resolving queries. These negative experiences aren’t isolated cases – multiple people have noted poor communication and unprofessional behavior.

Although other aspects of American IRA have been praised, customer service is something potential clients need to consider. American IRA must address these concerns quickly and effectively to keep a good reputation.

American IRA is a great choice for smooth transactions and affordable investments – a relief from financial headaches.

Positive experiences with smooth transactions and affordability

Customers are singing praises of American IRA for its hassle-free and cost-effective service when managing self-directed IRAs.

They are pleased with the quickness and accuracy of their transactions.

They are even more content with the fees charged by American IRA compared to other competitors.

The process of opening accounts and conducting transactions is seamless and effortless.

Investors benefit from various investment options at good prices.

American IRA’s commitment to customer satisfaction goes beyond just transactions and pricing. They provide great customer support, so clients get help whenever they need it. This top-notch support adds to their smooth transactions and affordability, solidifying American IRA’s status among customers.

Importance of Speaking to a Person when Contacting American IRA

If you’re contacting American IRA, it’s important to speak with someone! This is key for clear communication and personalized help. Plus, customers get quick answers to their questions. Many reviews praise American IRA’s knowledgeable and helpful staff!

Speaking with representatives gives customers guidance and support in setting up and managing accounts. Plus, they have direct access to a person — no miscommunication! And clients can rely on the expertise of American IRA’s team.

Speaking to a person is really important when contacting American IRA. It brings better understanding, personalized help, and ensures investors get the info they need to make informed decisions about their self-directed IRAs.

American IRA Final Thought

American IRA has proven to be a reliable option for precious metals investors. In this conclusion, we will provide a summary of the strengths and limitations of American IRA, along with an exploration of other reviews and alternative options for those looking to invest in precious metals. Stay tuned to make an informed decision about your investment journey.

American IRA possesses many strengths and limitations that must be taken into account.

To start, they specialize in self-directed IRAs, providing an array of account types and investment opportunities. This gives customers more control over their funds and permits them to diversify their portfolios.

American IRA has earned positive customer reviews, with several people commending the staff’s professionalism and responsiveness. This reveals the quality of customer service offered.

Some customers have experienced dissatisfaction with customer service, revealing an area that needs to be improved. It is essential for American IRA to address these issues and guarantee a consistently positive experience for all customers.

Moreover, when compared to other competitors such as E*TRADE, American IRA stands out. They grant competitive fees for their services and offer comprehensive support for customers during their investment journey.

To conclude, customers should consider these strengths and limitations when selecting American IRA for their investment needs. They provide a wide range of account types and investment options, enabling customers to have more control and diversify their portfolios. They have gained positive reviews, yet have had some unfavorable customer service experiences, necessitating improvement. And, they offer competitive fees and comprehensive customer support when compared to other companies.

Some Facts About American IRA Review:

✅ American IRA is a self-directed IRA administrator that specializes in various types of investments, including real estate, precious metals, private placements, and private lending. (Source: Team Research)

✅ They have received positive reviews from their customers, with an average rating of 5 stars based on 37 customer reviews. (Source: Team Research)

✅ Customers have praised American IRA for their exceptional customer service, knowledge, and promptness in assisting with self-directed IRAs. (Source: Team Research)

✅ Some customers have mentioned experiencing slow response times and a lack of guidance from American IRA. (Source: Trustpilot)

✅ American IRA offers various types of retirement accounts, including traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, HSAs, and education savings accounts. (Source: Innovative Wealth)

FAQs About American Ira Review

Are the prices offered by American IRA competitive?

American IRA has been praised for its affordable and competitive prices in managing finances. Customers have expressed satisfaction with the company’s fee schedule, which promises a low set fee for their services.

: Is American IRA a reliable self-directed IRA administrator?

American IRA has received positive reviews for its customer service, knowledge, and promptness in assisting customers with their self-directed IRAs. They have an A+ rating from the Better Business Bureau and have been in business for over 34 years, making them a trustworthy choice for self-directed account management.

Does American IRA provide timely responses to customer inquiries?

American IRA has been commended for its timely responses to customer inquiries. Several customers have mentioned that the company’s staff is efficient and responds quickly, providing exceptional service.

What are some valid customer complaints about American IRA?

While American IRA has received positive reviews overall, there have been a few valid customer complaints. Some customers have mentioned slow response times and a lack of guidance, feeling that the company only cares about taking their money. These complaints highlight areas where American IRA can improve its customer service.

What are the strengths of American IRA as a self-directed IRA provider?

American IRA has several strengths as a self-directed IRA provider. They offer a wide range of account types and investment options, including real estate, precious metals, private placements, and private lending. They also have positive customer reviews and 34 years of experience in the industry, making them a reputable choice for self-directed investing.

Who are the key executives of American IRA?

The key executives of American IRA are CEO Jim Hitt and President Sean McKay. Jim Hitt has over 40 years of experience in investing and has developed and maintained multi-million dollar businesses and properties. Sean McKay has 15 years of experience in real estate investing and is involved in various real estate organizations. Their expertise contributes to the company’s success in the self-directed IRA industry.