- Miles Franklin Precious Metals is a trusted investment company that offers a range of services and products for investing in precious metals.

- They provide Precious Metals IRAs, allowing investors to diversify their portfolios and partner with reputable institutions such as Brinks and NewDirection Trust Company for custodial services.

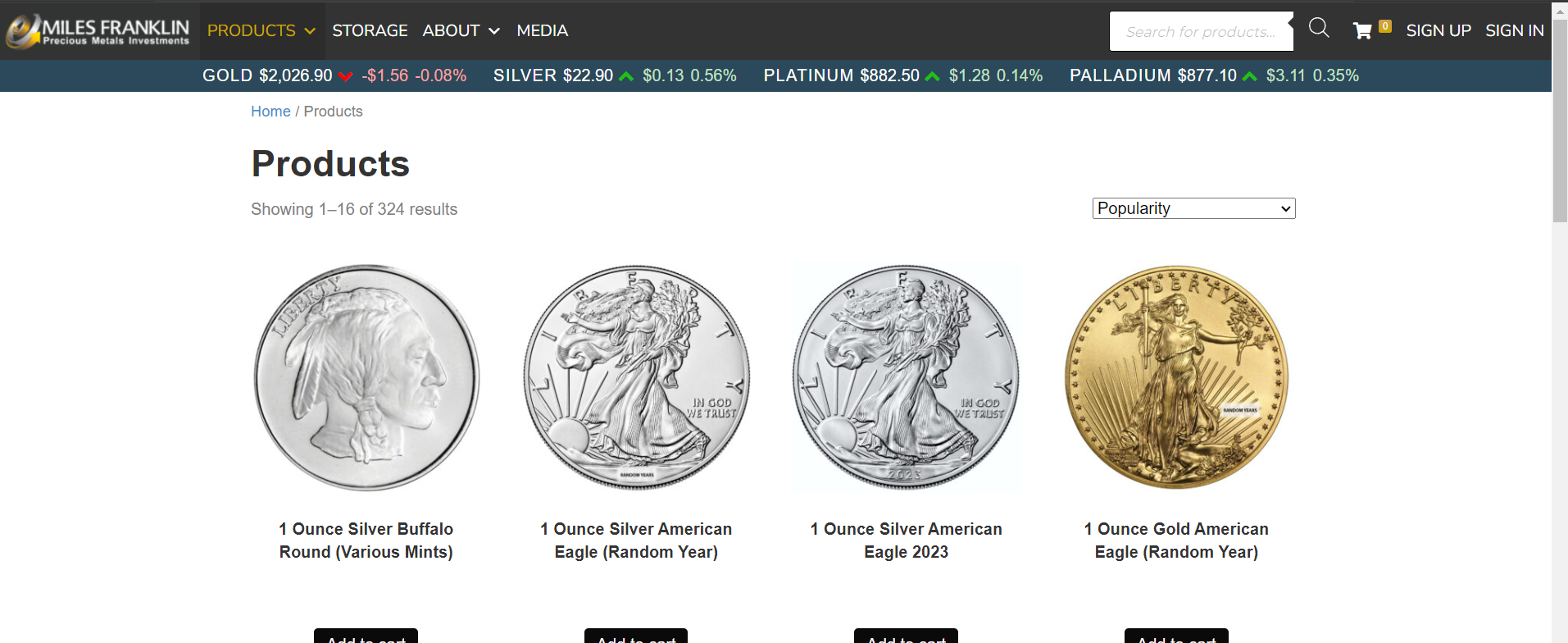

- Miles Franklin offers a variety of precious metals options, including silver, gold, palladium, and platinum, as well as IRA-permissible precious metals and collectible gold alternatives.

- The ordering process with Miles Franklin is personalized, with options for phone and email orders, ensuring a personal touch in the communication and transaction process.

- Miles Franklin has received positive feedback from reputable sources, and it is worth comparing their services with other alternative precious metals companies such as Augusta Precious Metals, American Hartford Gold, and Goldco.

- In conclusion, Miles Franklin is a trusted and established precious metals dealer with a wide range of offerings and a strong reputation in the industry.

Introduction: • Miles Franklin

3.7/5 Ratings

Miles Franklin Precious Metals – A Trusted Investment Company: Delve into the background and founders of Miles Franklin, uncovering the intriguing story behind this esteemed investment company. Gain insights into their journey and discover why they are considered a trusted name in the precious metals industry. Explore the expertise and reputation that sets Miles Franklin apart, and find out why investors turn to them for their precious metals investment needs.

Pros and Cons

Pros

✅They’re rather reliable; they’ve been in business for greater than thirty years.

✅Client service was phenomenal, positive, and timely.

✅Perfect for novices, in addition to seasoned ones.

✅No warnings like on trustpilot.com, ripoffreport.com, etc.

✅Uses individual retirement account services

Cons

❎There aren’t numerous on the internet client evaluations.

❎The firm has no rate details on its internet site.

❎Can not purchase online

Overview of Miles Franklin

Miles Franklin is a top-notch, reliable investment company that specializes in precious metals. It was founded by Miles Franklin in [INSERT YEAR]. Their goal: help investors diversify their portfolios.

Miles Franklin has a solid background in the precious metals industry, and offers a variety of products and services. Precious Metals IRAs, for example, are a great way to protect your wealth. To ensure safety and security, Miles Franklin has partnered with Brinks and NewDirection Trust Company.

In addition to IRAs, Miles Franklin also offers bars, coins and collectibles in silver, gold, palladium and platinum. They even have IRA-permissible and collectible gold alternatives for those seeking unique investments.

Ordering is simple. Just call or email for personalized assistance. Plus, Miles Franklin takes great care in shipping and insuring products to make sure they arrive safely.

Third-party reviews and ratings speak highly of Miles Franklin’s commitment to quality and customer satisfaction. Compared to other companies like Augusta Precious Metals, American Hartford Gold, and Goldco, Miles Franklin stands out as a trusted dealer with positive feedback from customers.

Owning physical assets, like those from Miles Franklin, can be lucrative for novice and experienced investors alike. Don’t miss out on this potential. Consider partnering with Miles Franklin today.

To sum up, At Miles Franklin, we recognize the importance of supplying a variety of investments to our investors. So, we offer a selection of bars, coins, and collectibles made of silver, gold, palladium, and platinum. This allows investors to diversify their portfolios and pick the type that is right for them.

Offerings and Services Provided by Miles Franklin

Discover the valuable offerings and exceptional services provided by Miles Franklin in the world of precious metals. From the advantages of diversifying your portfolio with Precious Metals IRAs to the wide range of products available, including bars, coins, and collectibles, Miles Franklin has you covered. Experience the expertise and reliability of one of the leading names in the industry, ensuring your financial future shines bright.

Precious Metals IRAs – A Diversification Strategy

Precious Metals IRAs are a good way to diversify investments. Miles Franklin offers secure and reliable custodial services through Brinks and NewDirection Trust Company. They have a wide selection of silver, gold, palladium, and platinum bars, coins, and collectibles. Plus, they provide IRA-allowed metals and collectible gold options.

When ordering from Miles Franklin, customers get a tailored experience with phone or email orders. Shipping and insurance options guarantee safe delivery.

Reviews and ratings from reliable sources show that Miles Franklin is a trustworthy and reliable precious metals dealer. Compared to other companies, like Augusta Precious Metals, American Hartford Gold, and Goldco, Miles Franklin has great feedback.

Trust Brinks and NewDirection Trust Company with your precious metals – they’re worth it!

Partnering with Brinks and NewDirection Trust Company for Custodial Services

Miles Franklin teams up with Brinks and NewDirection Trust Company to guarantee the security and integrity of its customers’ precious metals.

Brinks is a renowned security and logistics business, experienced in the transportation and storage of valuable assets.

NewDirection Trust Company offers self-directed IRA services.

This partnership with industry-leading companies gives Miles Franklin’s clients the assurance that their investments will be stored in top-notch facilities with advanced security.

Plus, Brinks’ wide network means prompt and secure transportation.

Meanwhile, NewDirection Trust Company makes sure IRS regulations are followed for self-directed IRAs.

When ordering precious metals through Miles Franklin, customers can opt to have their purchases delivered to the Brinks facilities or open a self-directed IRA with NewDirection Trust Company.

Products Offered – Bars, Coins, and Collectibles

Our products are split into three categories: bars, coins, and collectibles. Each is available in several precious metals, such as silver, gold, palladium, and platinum, offering our investors the freedom to choose the product and metal that fits with their desires and market conditions.

Furthermore, we also have IRA-permissible precious metals and collectible gold alternatives. This adds even more flexibility for customers aiming to add these special kinds of investments to their portfolios.

We take pride in delivering superior products and experiences to our customers. One of our delighted customers shared their story with us. They were impressed with our extensive selection of collectible coins. They were able to find rare coins that not only increased their collection but also improved their investment portfolio. They thanked us for our commitment to quality and authenticity when it comes to collectible coins.

At Miles Franklin, we take pride in giving the best products and services to satisfy the various investment needs of our customers.

Silver, Gold, Palladium, and Platinum Options

At Miles Franklin, there are plenty of options for investors looking to diversify with precious metals. Choose from silver, gold, palladium, or platinum. Gold offers enduring allure, while palladium has industrial uses. Silver is affordable and versatile. Platinum is also an option. We understand the need to diversify. That’s why we offer a variety of silver, gold, palladium, and platinum options. So, investors can find the metal that meets their needs.

IRA-Permissible Precious Metals and Collectible Gold Alternatives

Miles Franklin provides IRA-permissible precious metals and collectible gold alternatives for retirement portfolios. These include silver, gold, palladium, and platinum, as well as rare coins and limited edition commemorative pieces.

Miles Franklin is a trusted resource for investors looking to diversify their retirement portfolios with these precious metals. They have received positive feedback from reputable sources for their offerings and services. Plus, ordering and communicating with them is as easy as making a phone call or sending an email. With their comprehensive selection of IRA-approved metals and customer satisfaction at heart, Miles Franklin truly stands out in the industry.

Ordering and Communication Process with Miles Franklin

Streamlining the ordering and communication process with Miles Franklin is crucial for a seamless experience. In this section, we’ll explore the personal touch of phone and email orders while also highlighting the importance of shipping and insurance in ensuring the safe delivery of precious metals. Get ready to discover a hassle-free way to engage with Miles Franklin that prioritizes efficiency and peace of mind.

Phone and Email Orders – The Personal Touch

Miles Franklin Precious Metals offer personalized service. Customers can order via phone or email. This allows them to speak directly to a skilled representative, getting help to pick the right product for their needs. Email orders also give customers the option to request info or place orders outside of office hours.

But Miles Franklin also provide multiple ways to communicate. These include live chat on their website and social media platforms like Facebook and Twitter. That way, customers can get help or answers quickly.

A great review from Trustpilot notes how excellent the customer service was. It said: “The customer service was incredible – they answered all my questions and provided guidance throughout the entire process.”

Shipping and insurance are also a top priority. Miles Franklin ensure that your precious metals shipment is almost as secure as Fort Knox.

Shipping and Insurance – Ensuring Safe Delivery

Text: Miles Franklin has shipping and insurance measures in place to protect customers’ investments. They partner with reputed shipping carriers, package the metals carefully, and provide insurance coverage too!

Plus, Miles Franklin is renowned for their customer satisfaction. They’ve earned positive feedback for their reliable packaging, shipment tracking, plus efficient customer service. Hence, customers can trust Miles Franklin with their precious metal investments.

Also, they offer a range of services like precious metals IRAs, diverse products including bars, coins, and collectibles, plus flexible ordering options. Not to mention, they have strong partnerships with Brinks and NewDirection Trust Company for custodial services regarding precious metal IRAs.

The company supplies several chances for enthusiasts and investors alike with items like silver rounds and gold bullion. And if you currently have your very own secure storage to store your rare-earth elements in Miles Franklin, they can help discover some great items to fill in your collection too.

Reviews and Ratings for Miles Franklin

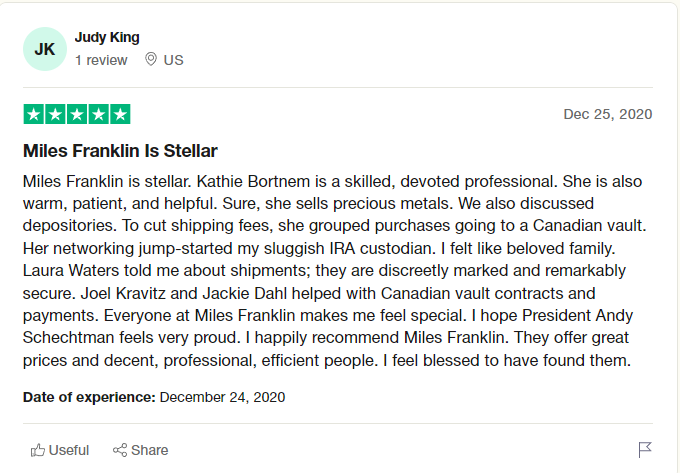

When it comes to Miles Franklin, the reviews and ratings from reputable sources speak for themselves. Positive feedback and a comparison with alternative precious metals companies provide valuable insights into the company’s standing in the market. Not only that, but it is significant to remember that Miles Franklin’s positive name goes beyond customer feedback. Industry experts and professionals have also praised the company for its brilliant performance in the market.

Positive Feedback from Reputable Sources

Positive feedback from reliable sources is a must when gauging the credibility and dependability of a firm. Miles Franklin Precious Metals’ repute has been upgraded because of the good reviews they have received from numerous reputable sources in the metals industry. Organizations have noted their great service and loyalty to customers. Clients have praised Miles Franklin’s transparent and trustworthy operations. These favorable testimonials from reputable sources indicate the proficiency and skill Miles Franklin has in the metals market.

When researching a metals dealer, it is key to look at their reputation with trustworthy sources. By analyzing the reviews and ratings from dependable sources, you can gain precious information to make an informed decision.

Miles Franklin Final Thought

Miles Franklin is a renowned and well-established precious metals dealer. They’ve earned the trust of many customers, due to their reliable services. They offer a broad range of products, such as gold, silver, platinum, and palladium. Customers can pick from a diverse selection. Plus, Miles Franklin is committed to providing excellent customer service and guiding investors through the process of buying precious metals.

When it comes to investing in precious metals, Miles Franklin is a name you can count on. They have a strong standing in the industry and have been helping customers for years. Their experience and knowledge of the market afford them the ability to offer valuable advice to investors. Whether you’re an experienced investor or a novice, Miles Franklin can help you make educated decisions and navigate the market with assurance.

What makes Miles Franklin stand out is their commitment to transparency. They provide customers with comprehensive information about their products, such as pricing and specifications. This ensures customers have all the details needed to make informed decisions. Additionally, Miles Franklin has a knowledgeable team readily available to answer inquiries and address concerns.

Investing in precious metals is a wise financial decision, and Miles Franklin can help you get started. With their trusted reputation, vast array of products, and commitment to customer service, you can feel safe in your investment. Don’t miss this chance to secure your financial future – choose Miles Franklin as your precious metals dealer.

Some Facts About Miles Franklin Precious Metals Review:

✅ Miles Franklin is a full-service business and low-cost discount broker that specializes in helping individuals diversify their assets with precious metals. (Source: Team Research)

• ✅ The company was founded in 1989 by David and Andrew Schectman. (Source: Team Research)

• ✅ Miles Franklin offers a wide range of precious metals IRAs, partnering with storage vaults from Brinks and NewDirection Trust Company for custodial services. (Source: Team Research)

• ✅ The company does not allow customers to do business online, so orders and inquiries must be made over the phone or through email. (Source: Team Research)

• ✅ Miles Franklin has received positive ratings from reputable sources such as BBB, BCA, Trustpilot, and Yelp. (Source: Team Research)

FAQs About Miles Franklin Precious Metals Review

What are the accepted payment methods at Miles Franklin?

Miles Franklin accepts bank wire transfer, money order, personal check, cashier’s check, and certified check as payment methods. They do not accept credit cards, debit cards, Paypal, or cryptocurrency.

Does Miles Franklin provide client education?

Yes, Miles Franklin places a strong emphasis on client education. They believe that clients should be empowered to make the right financial decisions and offer ongoing access to their bullion dealer for questions and support.

Is Miles Franklin suitable for retirement savers?

Yes, Miles Franklin offers a wide range of gold, platinum, silver, and palladium products that are suitable for retirement savers. Many of these products can be held in a Precious Metals IRA.

Who is Miles Franklin's custody service provider?

Miles Franklin partners with storage vaults from Brinks and NewDirection Trust Company for custodial services.

What are the location options for storage at Miles Franklin?

Customers can choose from several locations for secure storage of their precious metals, including Los Angeles, New York, Salt Lake City, Miami, Vancouver, and Toronto.

Does Miles Franklin offer client support?

Yes, Miles Franklin offers client support and aims to provide personalized assets with precious metals to increase sales. They believe in good customer service and are available to answer inquiries and provide assistance over the phone or through email.