• Merrill Lynch does not offer an IRA that can hold physical gold and silver.

• Investors interested in precious metals may consider Goldco as a top gold investing company.

• A gold IRA allows for diversification and wealth preservation, offering protection against inflation and contributing to financial stability.

• Comparing a gold IRA to a traditional IRA includes benefits such as tax-deductible contributions and tax-free distributions at retirement age.

• Bullion coins with a 99.5% fineness level and bullion bars with a 99.9% purity rating are approved gold assets for a gold IRA.

• Gold IRAs provide value retention, hedge against inflation and economic crises, and offer diversification benefits in minimizing risk as investors approach retirement age.

• Merrill Lynch offers portfolio management services tailored to clients’ financial goals.

• Merrill Lynch’s target market typically consists of higher net-worth individuals, with automated programs available for lower net-worth clients with fewer fees.

• Merrill Lynch does not offer a gold IRA option, but investors interested in precious metal investments may consider Goldco.

Related Post:

401K to Gold IRA Rollover Guide

Introduction: Merrill Lynch

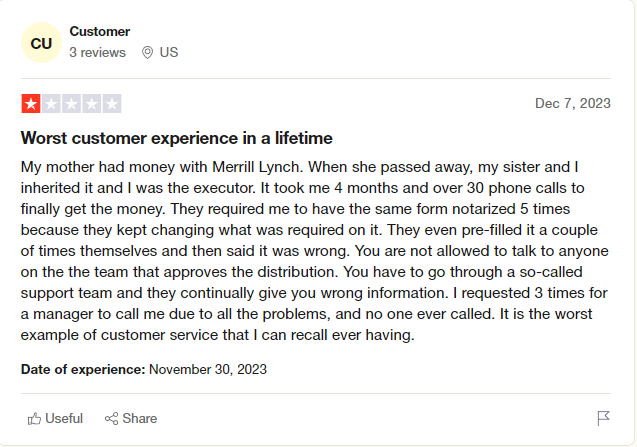

1.3 Ratings

Merrill Lynch Wealth Management offers comprehensive account management assistance and professional investment advice. However, it’s important to note that Merrill Lynch does not provide an IRA option that allows for the holding of physical gold and silver. For investors interested in precious metals, an alternative option worth considering is Goldco, a top gold investing company.

Pros and Cons

Pros

✅Reduced trading charges

✅Easy and smooth account opening

✅Strong moms and dad business

Cons

❎No trial account

❎ Limited to United States clients and items

❎Few choices for deposit/withdrawal

Overview of Merrill

Merrill Lynch is known for its account management help and professional investment counsel. Their team of advisors is devoted to helping clients reach their financial objectives through custom solutions and strategic guidance. With a concentration on understanding each client’s one-of-a-kind needs, Merrill Lynch provides an array of investment options and tactics to maximize returns and reduce risks. From diversification of portfolios to asset allocation, their advisors use their extensive understanding of the market to give tailored advice that aligns with each client’s circumstances and goals.

Merrill Lynch does not provide an Individual Retirement Account (IRA) choice specifically for physical gold and silver holdings. But, they specialize in traditional investment paths. For those wishing to have precious metals in their retirement accounts, other options are obtainable in the market.

To sum up, Merrill Lynch prides itself on its proficiency in account management assistance and expert investment advice. Though they may not offer a gold IRA option, other companies like Goldco provide opportunities for those wishing to include precious metals in their retirement portfolios. With a concentration on individualized solutions,

Merrill Lynch not offering an IRA that can hold physical Gold and Silver

Merrill Lynch, a top wealth management firm, doesn’t have an Individual Retirement Account (IRA) that lets investors hold physical gold and silver. They don’t provide this option for clients, even though they offer account management and investment advice.

People who want to invest in gold and silver through an IRA need to consider other options. A gold IRA, also known as a self-directed IRA, gives benefits like diversification and wealth protection. Contributions to a gold IRA aren’t tax-deductible, but people can get tax-free distributions when they retire. People with a traditional IRA can do a gold IRA rollover to move assets to an account with precious metal holdings.

Merrill Lynch’s Account Management Assistance and Professional Investment Advice

The approved assets for a gold IRA are bullion coins with a 99.5% fineness level and bullion bars with a 99.9% purity rating. Gold is a safe investment that keeps its value and is a good hedge against inflation and economic issues. By diversifying their retirement portfolio with gold IRAs, people can reduce risk as they near retirement age.

Merrill Lynch doesn’t let clients hold physical gold and silver in their IRAs. They do, however, offer portfolio management services. Their advisors customize strategies to fit clients’ financial goals. Merrill Lynch typically works with high net worth people, but they also have automated programs with lower fees for smaller portfolios.

Reinforcement of Merrill Lynch not offering a gold IRA option

Merrill Lynch stands firm and does not offer a gold IRA option. Their account management and investment advice is detailed, but no mention of a physical gold or silver IRA. Instead, they focus on portfolio services and wealth strategies. This backs their choice to not have this type of investment in their range.

But those interested in gold and silver should consider Goldco as their gold investing company. Goldco helps spread investments over different accounts and keeps wealth safe with approved gold assets in IRAs. This gives investors the chance to learn about gold IRA’s and get help from professionals like Goldco.

Merrill Lynch does not tell you about the approved gold assets or the advantages of precious metals in an IRA. This underlines that they do not include this opportunity. If you want to invest in approved gold assets, look at Goldco or other companies that specialize in precious metals IRAs.

Pro Tip: Research various companies and talk to financial advisors that understand the kind of investment you are looking at, such as precious metals. This will help you make wise decisions that match your objectives.

Merrill Lynch Wealth Management does not provide a gold IRA option. But, Goldco is the go-to choice for those wishing to invest in precious metals. They are experts in gold investing and have a great reputation. They assist investors and provide professional advice.

Merrill Lynch’s Portfolio Management Services

Merrill Lynch provides portfolio management services to help clients reach their financial goals. Professional advisors create tailored strategies to fit the needs and risk tolerance of each individual. This includes high net worth investors who require more specialized advice. For those with lower net worth, automated programs are available. Merrill Lynch staff use advanced technology to manage portfolios and maximize returns while minimizing risks.

Recap of Merrill Lynch’s Offerings and Services

Merrill Lynch helps clients with account management and professional investment advice tailored to their financial goals. However, they don’t offer an IRA with physical gold and silver. If Merrill Lynch were a superhero, their power would be saying ‘no’ to offering a gold IRA faster than a speeding bullet! Goldco is a great alternative, though. They specialize in setting up self-directed IRAs that allow for the inclusion of gold and other precious metals. These IRAs offer benefits like protection from inflation and potential for long-term growth.

Merrill Lynch Final Thought

Merrill Lynch may not supply a gold IRA option themselves, yet they offer strong portfolio control services over different asset classes. Their advisors work with clients to comprehend their financial goals and factors such as risk tolerance, time horizon, and liquidity requirements. Leveraging advanced analytics tools and market knowledge, Merrill Lynch’s portfolio control services attempt to optimize returns while properly controlling hazard.

It is crucial to remember that Merrill Lynch mainly caters to people with higher net worth. Nevertheless, they have automated programs for customers with lower net worth looking for competitive fee structures combined with professional investment advice fitted to their exact needs.

Some Facts About Merrill Review:

✅ Merrill Lynch Wealth Management does not offer an IRA that can hold physical gold and silver. (Source: BMO GAM Viewpoints)

✅ For investors looking to invest in precious metals and protect against inflation, Goldco is recommended as a top gold investing company. (Source: BMO GAM Viewpoints)

✅ A gold IRA is a self-directed Individual Retirement Account that allows investors to diversify their investments and preserve their wealth over the long run. (Source: BMO GAM Viewpoints)

✅ Precious metals in a gold IRA are kept in an IRS-approved safe depository until retirement age. (Source: BMO GAM Viewpoints)

✅ Gold IRAs offer the benefit of diversification, minimizing risk as investors approach retirement age. (Source: BMO GAM Viewpoints)

FAQs About Merrill Lynch Review

Can I invest in mining companies through Merrill Edge?

Yes, Merrill Edge allows you to invest in mining companies, which are closely connected to the prices of precious metals like gold and silver. You can trade stocks of mining companies directly from your Merrill Edge brokerage account.

How can I find precious metals stocks on Merrill Edge?

You can use the stock screener under the Research tab on Merrill Edge’s platform. Select “Materials” under the Sector & Industry Group heading to find a list of precious metals stocks available for trading.

Does Merrill Edge offer promotions for opening an account?

Yes, Merrill Edge offers promotions for opening an account. You can check their website or contact their customer service to learn more about the current promotions available.

Can I invest in physical gold through Merrill Edge?

While Merrill Edge allows you to invest in gold ETFs, it does not offer an IRA that can hold physical gold and silver. For investors looking to invest in physical precious metals, Goldco is recommended as a top gold investing company.

What are some popular gold ETFs available on Merrill Edge?

Merrill Edge offers popular gold ETFs such as GLD (100% invested in gold) and SLV (composed entirely of silver). These ETFs provide an opportunity to invest in precious metals without the volatility of individual stocks.

What fees does Merrill Edge charge for trading options?

Merrill Edge does not charge a base commission for trades of stocks, ETFs, or options. However, there is a per-contract fee of 65¢ for option trades.