- Fidelity Gold IRA offers a reputable and established platform for investing in gold for retirement. With a strong reputation and comprehensive financial services, Fidelity is a reliable option.

- Gold IRA investment provides a valuable opportunity for retirement planning, allowing individuals to diversify their portfolios and hedge against economic uncertainties.

- Augusta Precious Metals is a superior choice for retirement investing in precious metals, offering a comprehensive overview, numerous benefits, and positive customer reviews and ratings.

When it comes to investing in gold for your retirement, is Fidelity the right choice? In this review, we will explore Fidelity’s reputation and the financial services they offer as part of their Gold IRA. We’ll also delve into the benefits of a Gold IRA investment and how it can enhance your retirement planning. Additionally, we’ll discuss Fidelity’s self-directed IRA options and the availability of gold-backed items. Stick around to find out if Fidelity is the best option for your gold investment needs.

Pros and Cons

Pros

✅ Customers have praised Fidelity for its remarkable customer service! They talk about the helpfulness, knowledge, and professionalism of representatives they’ve encountered.

✅ Plus, customers are satisfied with Fidelity’s automated system efficiency. They appreciate the user-friendly interface, ease of use, and fast response times.

✅ These positive customer reviews illustrate the reliability and trustworthiness of Fidelity as a financial institution, giving investors peace of mind when investing in gold.

✅ Moreover, customers comment on how Fidelity’s gold IRA products have aided them to reach their retirement goals through strategic investment in precious metals.

Cons

❎Poor communication and lack of responsiveness from Fidelity’s customer service.

❎ Difficulties with the automated system. Customers have trouble accessing account information or changing investments.

❎ There are issues with account management, like delays or inaccuracies.

Overview of Fidelity

Fidelity is known for its great standing and vast selection of top-notch services in the financial world. They have a huge variety of monetary products and solutions, designed to meet the one-of-a-kind needs of investors. Fidelity puts a big focus on retirement planning, and offers individuals the ability to invest in gold through its Gold IRA investment program.

One of the key benefits of Fidelity’s Gold IRA is diversifying retirement portfolios with gold as an asset. This serves as a shield against inflation and economic turbulence, since gold has reliably been a dependable store of value. Fidelity’s Gold IRA gives investors different gold investment options, including physical gold, gold ETFs, and gold mining stocks.

Another awesome thing about Fidelity’s Gold IRA is the self-directed IRA feature, giving people more control over their investments and decisions based on their own studies and preferences. Additionally, Fidelity provides various gold-backed investment options, allowing investors to explore the gold market in different ways.

When comparing to other well-known companies in the industry, Fidelity stands out due to its large selection of offers and its great customer service. Plus, Fidelity has an efficient, user-friendly automated system.

If you are looking for an alternative to Fidelity’s Gold IRA, Augusta Precious Metals is an excellent option for retirement investing in precious metals. It provides similar benefits, such as diversification and protection from inflation, and receives positive reviews and ratings.

If you’re thinking of a Gold IRA investment, Fidelity’s fame and quality financial services will make it a trustworthy choice.

It is essential to note that categorizing data should be done strategically. The categories should be clearly-defined, MECE (mutually exclusive, collectively exhaustive), and connected to the objectives of the analysis. By adhering to these principles in categorization, individuals can maximize the value from analyzing complex datasets.

Features and Benefits of Fidelity

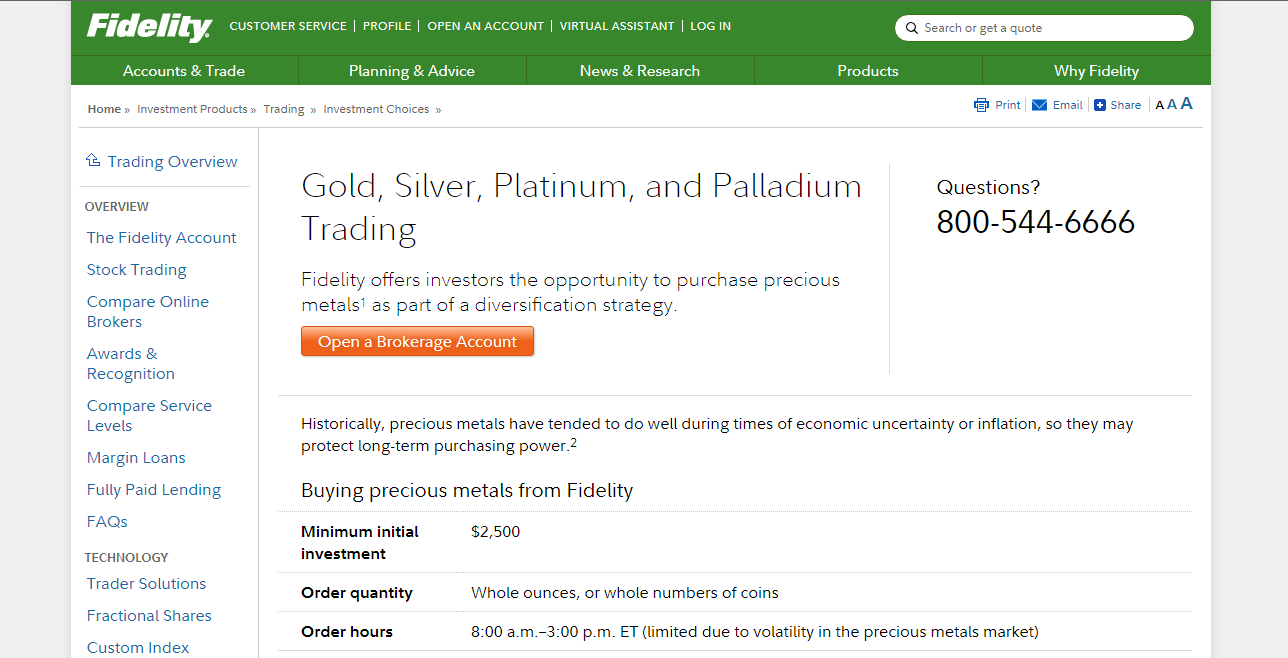

Fidelity offers multiple investment options for those who want to add gold to their retirement portfolios. For instance, a Gold IRA, or Individual Retirement Account, allows investors to purchase physical gold and other gold-related assets. This gives individuals the chance to diversify their retirement funds and potentially benefit from gold’s long-term growth.

Investment options for gold IRAs include gold ETFs, gold mining stocks, and physical gold. These options let investors pick investments that fit their risk tolerance and objectives.

Also, Fidelity offers self-directed IRAs which open up even more possibilities for investing in alternative assets, such as gold.

Overall, investing in a Gold IRA with Fidelity can give individuals the opportunity to diversify their retirement portfolios and take advantage of gold’s long-term growth.

Before investing in a Gold IRA with Fidelity, individuals should evaluate their investment goals, risk tolerance, and fees/requirements. This will help them make an educated decision about whether a Gold IRA with Fidelity is the best fit for their retirement planning needs.

Retirement planning: because one day you’ll want more than just a gold watch to show for all your hard work!

Retirement Planning

Fidelity knows how important retirement planning is. So, they provide services and options to help individuals reach their goals. With Fidelity’s expertise in financial management, they can help you allocate funds, manage risks, and maximize returns.

Plus, Fidelity offers a Self Directed IRA to give you control over your investments. You can choose from stocks, bonds, and even gold, so you can customize your strategy. Fidelity even offers gold-backed items, so you can get a hedge against inflation.

In conclusion, Fidelity provides the tools to help you invest for retirement. With their services and options, you can direct your own retirement with confidence.

Self Directed IRA

A self-directed IRA, also called an individual retirement account, gives individuals control over their retirement funds. This type of IRA lets people invest in a broad range of assets, like real estate, private equity, and precious metals.

Self-directed IRAs offer more choices than traditional IRAs. Plus, they offer tax benefits. Contributions to a self-directed IRA may be tax deductible or pre-tax. Also, earnings within the account can grow tax-deferred or even tax-free if it’s a Roth self-directed IRA.

However, people should consider the risks of non-traditional investments and have the knowledge to make good decisions. Research and due diligence should be done before investing in any asset class or alternative investment.

In conclusion, self-directed IRAs provide more control and the chance to diversify portfolios. It may not be suitable for everyone, but those willing to take on additional research and management responsibilities can gain more flexibility and potential for higher returns.

Gold Backed Items

Glimmering gold-backed items, like gold ETFs and shares of gold mining stocks, are available through Fidelity’s Gold IRA. These are backed by physical gold reserves, linking their value to the price of the precious metal.

One example is a gold ETF. It’s an investment fund that follows gold’s price and can be bought and sold on stock exchanges. These ETFs own bullion or other physical forms of gold, letting investors gain potential profits without the hassle of physical ownership.

Fidelity’s Gold IRA also has shares in gold mining companies. These companies own and operate mines, and their stock prices usually move with the price of gold. Investing in these shares lets individuals benefit from gold’s potential gains indirectly.

It should be noted that gold-backed items don’t entail direct ownership of physical bullion. So, if individuals want the security of owning physical assets, they should bear this in mind.

In conclusion, Fidelity’s Gold IRA offers various types of gold-backed items. These give investors exposure to gold’s price movement without needing to own or store the precious metal. Take advantage of these golden opportunities with Fidelity’s Gold IRA: explore dazzling assets and choices that’ll make your retirement shine.

Fidelity’s Gold IRA offers a wide range of investment options and choices for those looking to diversify their portfolio with gold. From gold ETFs and mining stocks to physical gold investments, this section will provide an overview of the various avenues available to investors interested in Fidelity’s Gold IRA.

The Reputation and Awards of Fidelity

Investing in gold provides many choices for people who want to diversify their portfolio and protect their savings from inflation. Fidelity’s Gold IRA has various investment options.

- Gold ETFs: Fidelity offers ETFs that track the price of gold. Investors can get exposure to the metal without owning it.

- Gold Mining Stocks: You can also pick gold mining stocks. This lets you indirectly benefit from a potential rise in gold prices.

- Physical Gold Investment: If you prefer, you can buy gold bullion coins or bars. This gives you tangible assets.

These choices give flexibility and suit different risk preferences. Investing in gold ETFs means easy liquidity and diversification. With mining stocks, you have potential growth. Owning physical gold gives you security and ownership.

It’s important to look at your goals, risk tolerance, and investment horizon when selecting. Also, evaluate any associated costs and fees. By doing this, you can decide which option suits your retirement plan best.

To sum up, Fidelity’s Gold IRA has various gold investment possibilities, including ETFs, mining stocks, and physical gold. Each has its own benefits and considerations based on individual investor needs. Thinking about factors such as liquidity, growth potential, and personal preference can help you make the right call about how to invest in gold for retirement.

Gold ETFs

Text: Gold ETFs provide an easy and economical way to invest in gold. They can be bought and sold like stocks, giving investors the ability to add or reduce their exposure to gold whenever they want.

No additional costs for storage and insurance are needed with gold ETFs, as they are held by a custodian on behalf of the investor. This makes them a more sensible option for retail investors who don’t have the resources to store physical gold.

Gold ETFs are also very liquid, as they can be traded during the trading day. This allows investors to buy or sell at current market prices, which gives them more flexibility than other forms of gold investing.

Investors don’t have to own physical bars or coins to gain exposure to the price movement of gold when using ETFs. This eliminates worries about safety and transport, making it an appealing choice for many.

Plus, ETFs enable fractional ownership. You can buy one share, which is the same as a fraction of an ounce of gold. This means individuals with smaller budgets can still get involved with the potential advantages of gold investments.

To sum up, Gold ETFs offer a straightforward way for investors to include gold price movements in their portfolio. They give convenience, cost-effectiveness, liquidity, and diversification benefits that make them a good choice for both individual and institutional investors seeking exposure to this precious metal.

But beware! Don’t be tricked by gold mining stocks – they may look attractive, but they’re only “fool’s gold”!

Gold Mining Stocks

Gold mining stocks are a hot commodity for investors seeking to benefit from the gold industry’s performance. (1)

Advantages of investing in gold mining stocks include:

- Exposure to the gold mining industry’s potential growth and profitability.

- The ability to diversify one’s portfolio and take advantage of gold price fluctuations.

- Significant reserves and exploration projects that could offer long-term value.

- The potential for dividends from companies generating consistent cash flow.

However, it’s important to note the risks associated with these investments. Factors such as global economics, geopolitical uncertainty, and commodity pricing all influence stock performance. (3) So, when considering gold mining stocks, investors should research the company, diversify their portfolios, and stay updated on market trends.

Fidelity Gold IRA is a reliable option for those wanting to invest in gold mining stocks. Their services and focus on gold investments make them an ideal partner in this endeavor.

Physical Gold Investment

Physical gold investment is vital for diversifying a retirement portfolio. It’s tangible and reliable, protecting wealth against inflation and currency devaluation. With Fidelity’s Gold IRA, investors have the option to buy gold bars/coins, invest in gold ETFs, or gold mining stocks. However, other companies offer similar options too. Comparing Fidelity’s Gold IRA to others is like pitting a T-Rex against herbivores – they can’t compete!

Comparison with Competitors

When it comes to investing in a gold IRA, it’s essential to compare different companies in the industry. In this section, we will explore the criteria used to evaluate these companies and examine three reputable contenders: Company A, Company B, and Company C. By delving into the details, we can gain valuable insights and make an informed decision about which company offers the most suitable option for a gold IRA investment.

Comparison Criteria

It’s key to set comparison criteria when comparing companies in the industry. This assists investors to make wise decisions, based on such factors as: reputation, services, customer reviews, fees, etc.

Analyzing Fidelity’s customer service and automated system, we will delve into the customer reviews and complaints. From assessing the customer service experience to evaluating the efficiency of the automated system, we will explore both the positive and negative feedback received.

Customer Support and Security Measures

Fidelity knows customer service matters. They have trained customer service staff, well-known for their professionalism and efficiency, providing help with investments and account management. Plus, Fidelity has invested in a streamlined automated system, allowing customers to monitor investments, track performance and make informed decisions about retirement planning.

Positive customer reviews back up Fidelity’s commitment to excellent customer service. Their knowledge, quick response times and willingness to go the extra mile, show they value their customers.

When investing retirement funds, customer service matters. Fidelity’s commitment to strong customer relationships and a positive experience, sets them apart from competitors.

But does their automated system deliver on customer satisfaction? AI efficiency can’t replace human contact.

Automated System Efficiency

Automated system efficiency refers to how effective and productive Fidelity’s automated system is with customer inquiries and transactions. It’s designed to streamline processes and create convenient solutions. Customer reviews and feedback praise the system for its reliability and responsiveness.

To understand Fidelity’s automated system efficiency, a table can be made. It can show key features and advantages like: ease of use, response time, accuracy and info availability. This will let readers compare Fidelity’s system with others.

Notably, Fidelity’s automated system is equipped with advanced tech, ensuring quick processing and minimal errors. The company has heavily invested in developing a platform to meet customer needs. This makes Fidelity’s automated system an efficient tool for managing retirement investments and transactions.

Customer Reviews and Ratings

Fidelity’s Gold IRA has had lots of great feedback from customers. People say they were very impressed with the customer service and how helpful Fidelity’s employees were. They also like Fidelity’s user-friendly online platform. It lets them easily access their accounts, make transactions, and simplifies the investment process.

These reviews give Fidelity a good reputation. Investors appreciate their trustworthiness, openness, and retirement planning solutions. Although there are some bad reviews, there aren’t many. These reviews tend to mention things like slow processing or difficulty using the website. It’s important to remember that not everyone has the same experience.

When looking at the reviews and ratings for Fidelity’s Gold IRA, it’s important to look at other factors like fees and requirements. The reviews are mostly positive. People like the customer service and automated system. They also think Fidelity is reliable, even if they have minor problems.

Overall, customer reviews give a good idea of how good Fidelity’s Gold IRA services are. If Fidelity’s Gold IRA isn’t right for you, there are plenty of other options for investing in physical gold.

Fidelity Final Thought

When investing in gold for your retirement, it is important to make an informed decision. Analyzing Fidelity’s Gold IRA and other respected companies is recommended. Consider these key points:

- Compare Fidelity’s reputation and financial services with other companies.

- Look at the gold investment options, such as Gold ETFs, gold mining stocks, and physical gold.

- Review customer service and efficiency of Fidelity’s automated system.

Explore alternatives to Fidelity’s Gold IRA, such as Augusta Precious Metals. They may offer benefits that fit your retirement goals better. Consider fee structure, minimum investments, and any additional costs. This helps determine if the investment is within your financial abilities and objectives.

25% of retirees hold some portion of their retirement savings in physical gold or precious metals. To sum up, evaluate Fidelity’s Gold IRA and other reputable companies, explore alternatives, and consider fee structure and costs before making a decision.

Some Facts About Gold IRA Fidelity Review:

✅ Fidelity Gold IRA received a rating of 2.8 out of 5 stars. (Source: Team Research)

✅ Fidelity is a well-known financial services company with over $4.9 trillion under management. (Source: Team Research)

✅ Fidelity’s gold IRA is not self-directed, unlike other reputable companies in the industry. (Source: Team Research)

✅ Fidelity offers the option to invest in a gold ETF, but it is not their own gold IRA. (Source: Team Research)

✅ Augusta Precious Metals is recommended as a superior choice for retirement investing in precious metals. (Source: Team Research)

FAQs about Gold Ira Fidelity Review

What is a self-directed IRA and does Fidelity offer it for gold investments?

A self-directed IRA is a retirement account that allows investors to choose and manage their own investments, including physical gold. Unfortunately, Fidelity does not offer a self-directed gold IRA.

How is Fidelity’s customer service for gold IRA investors?

Fidelity’s customer service for gold IRA investors has received mixed reviews. Some customers have complained about customer service and the automated system on their website. It is important to consider this factor before choosing Fidelity for your gold IRA investment.

What are some of the challenges of investing in gold IRAs?

Investing in gold IRAs can come with challenges such as market fluctuations and the potential for value depreciation. It is important to be aware of these risks and consult with a financial advisor to minimize challenges.

Is gold considered a safe investment for retirement?

Gold is often considered a safe investment for retirement due to its reputation as a valuable and stable asset. It can act as a hedge against inflation and economic uncertainties. However, it is important to diversify your investment portfolio and consider individual financial goals and risk tolerance.

Are there any important warnings to consider when investing in Fidelity’s gold mutual funds?

When investing in Fidelity’s gold mutual funds or any investment, it is important to be aware of potential risks and market volatility. It is recommended to thoroughly research the fund and consult with a financial advisor to understand the potential rewards and risks associated with the investment.

What are the support hours for BullionVault customer service?

Investing in gold stocks can provide exposure to the gold market without the need to purchase or store physical metals. It allows investors to potentially benefit from the performance of gold miners and the overall gold industry. However, it is important to carefully research and analyze individual gold stocks before making investment decisions.