- Charles Schwab offers a comprehensive review of its Gold IRA services, providing investors with an opportunity to invest in precious metals as part of their retirement portfolio.

- Investors can access physical gold through a Charles Schwab brokerage account, giving them the advantage of owning tangible assets that may provide protection against inflation and currency devaluation.

- It is important to understand the eligibility criteria and withdrawal rules associated with a Gold IRA, as well as the potential fees and limitations of the Charles Schwab Gold IRA service.

Related Post:

Introduction: Charles Schwab

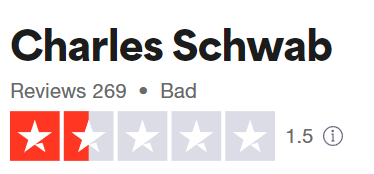

1.5/5 Ratings

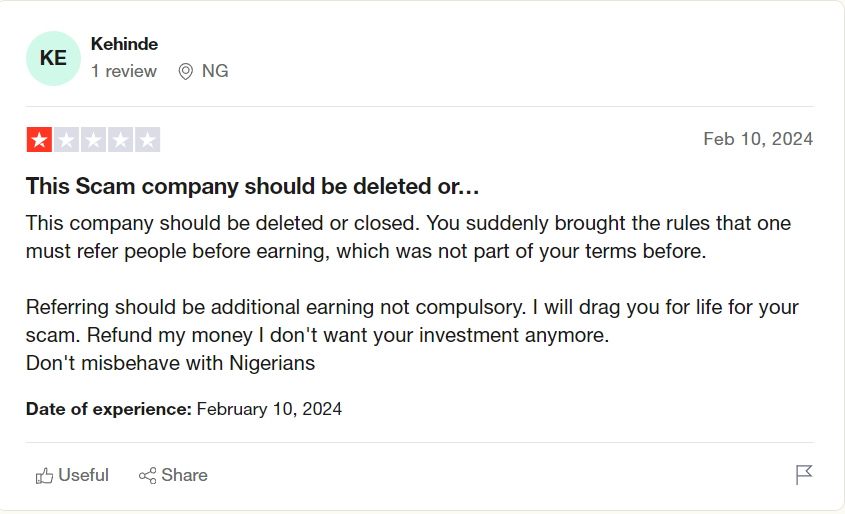

Charles Schwab Gold IRA Review offers a comprehensive analysis of Schwab’s Gold IRA services, providing valuable insights for investors. Explore the variation in their offerings and discover the benefits of diversifying your portfolio with precious metals. It is important to compare Charles Schwab Gold IRA services to other companies that specialize in gold IRAs. This will help ensure investors make informed decisions. Charles Schwab also provides proactive investment management and advisory services.

Pros and Cons

Pros

✅ Affordable Trades – you can buy and sell with low costs, so you get more from your investments.

✅ Banking & Lending Products – Schwab provides you with a wide range of bank and loan options for complete financial solutions.

✅ Commission-free Funds – Invest your money without extra fees or expenses.

Cons

❎One drawback is the limited availability of alternative assets.

❎Charles Schwab has competitive pricing and low-cost trades, there could be fees associated with maintaining an IRA or certain transactions.

❎high minimums for certain accounts could be a challenge.

Overview of Charles Schwab

The Charles Schwab Corporation: A comprehensive overview of its background and services offered.

Background and Services Offered by Charles Schwab

Charles Schwab Corporation is a top brokerage firm. They offer various investments to their clients. With strong experience in the financial industry, they have a great reputation for reliable and innovative solutions. Their services include wealth management, advisory services, accounts, banking products, and retirement planning.

One of their services is a Gold IRA. This allows investors to include gold in their retirement accounts. It’s an alternative way to diversify and protect savings. To qualify, investors need a self-directed IRA and meet IRS regulations.

Investing in gold through Charles Schwab gives access to physical gold in their account. This offers security and protection against bad economic times. Additionally, it can provide protection from inflation and currency fluctuations.

Investors should be aware of any penalties for withdrawing money early from their Gold IRAs. Also, they must take required minimum distributions after age 72.

For those rolling over existing retirement funds, there are direct rollovers or transfers from other qualified retirement accounts.

When looking into Charles Schwab’s Gold IRA services, compare them with other companies. They offer competitive prices and provide proactive investment management and advisory services. These can help investors make informed decisions about their retirement savings.

To sum up, Access precious metals to diversify portfolios with tangible assets like physical gold. Have a hedge against market volatility and inflationary pressures, and benefit from Charles Schwab’s investment professionals. Marry gold for a forever investment, ditch the papers and melt your worries away.

Understanding Charles Schwab’s Gold IRA Services

Charles Schwab offers a range of services for Gold IRAs, including traditional and self-directed options. In this section, we will explore the key differences between these two types of IRAs and delve into the eligibility criteria for opening a Gold IRA with Charles Schwab. By understanding these aspects, you can make an informed decision about the best way to secure your financial future with gold investments.

A Comprehensive Review of Charles Schwab’s Gold IRA Services

Fear of missing out? Get ready to dive into the goldmine of Charles Schwab Corporation! This comprehensive review of their Gold IRA services provides invaluable details and insights for investors considering this investment option.

Discover the differences between Traditional and Self-directed IRAs, eligibility criteria, access to precious metals, withdrawal rules, rollover options and more! Plus, compare Charles Schwab to other companies specializing in Gold IRAs.

Learn about the pros and cons of choosing Charles Schwab for a Gold IRA, and find out about fees and limitations related to alternative assets. Make informed decisions about your retirement investments with Charles Schwab by considering factors such as affordable trades, banking products, commission-free funds and account minimums.

This comprehensive review is the ultimate financial institution for your investment needs! Gain confidence in your decision-making process and ensure you are making the best choice that aligns with your financial goals.

Evaluating Charles Schwab Gold IRA Services

When it comes to evaluating Charles Schwab Gold IRA services, there are a few key factors to consider. In this section, we will compare Charles Schwab with other companies that specialize in Gold IRAs, exploring the differences and advantages they offer. Additionally, we will delve into the proactive investment management and advisory services provided by Schwab, shedding light on how they stand out in their approach. Let’s dive in and assess the unique aspects of Charles Schwab’s Gold IRA services.

Comparison with Other Companies specializing in Gold IRAs

Charles Schwab’s Gold IRA services provide distinct advantages compared to other companies specializing in Gold IRAs.

Charles Schwab offers both physical gold and ETFs for investment. Competitor A only has physical gold. Competitor B has a wider range of precious metals.

Charles Schwab provides self-directed investment opportunities. Competitors A and B offer self-directed or managed options.

Charles Schwab has a minimum investment of $5,000. Competitor A requires $10,000 and Competitor B has $2,500.

Charles Schwab follows a competitive fee structure. Its competitors may have varying fee structures or charge a flat fee.

These comparisons show Charles Schwab’s strengths. Investors should evaluate them based on their specific goals and preferences.

IRA Withdrawal Rules and Regulations

When it comes to IRA withdrawal rules and regulations, understanding the penalties for early withdrawals and required minimum distributions is crucial. Additionally, knowing your rollover options for retirement funds into a precious metals IRA can offer potential benefits. By exploring these sub-sections, we will shed light on the important guidelines and considerations that can help you navigate the intricacies of managing your IRA effectively.

Penalties for Early Withdrawals and Required Minimum Distributions

Early withdrawals from an IRA before 59½ may be subject to penalties and taxes from the Internal Revenue Service (IRS). These penalties and required minimum distributions (RMDs) are meant to discourage people from taking out funds early, as IRAs are designed for retirement savings. For early withdrawals, the IRS has a 10% penalty plus regular income taxes. However, there are exceptions, such as using funds for medical bills that exceed a certain percentage of adjusted gross income or a first-time home purchase.

RMDs must be taken from an IRA yearly once 72 years-old. Not taking RMDs can result in a 50% penalty. It’s important to know and follow these rules to avoid penalties and stay compliant with IRS regulations.

To avoid penalties and satisfy RMDs, investors should get advice from financial advisors or tax professionals who specialize in retirement planning. They can help individuals understand complex rules and regulations. People should also review their investment portfolio and adjust it as necessary. By remaining informed and getting professional help when needed, investors can reduce penalties and maximize the growth potential of their IRAs.

Charles Schwab provides precious metal options for rolling over retirement funds, worth their weight in gold!

Rollover Options for Retirement Funds into a Precious Metals IRA

Are Charles Schwab’s Gold IRA Services the golden ticket to retirement riches? Or is it just fool’s gold?

Investors can roll over their traditional IRA or qualified employer-sponsored 401(k) into a Precious Metals IRA with Charles Schwab.

The process is simple – contact customer service or visit a branch location.

Once completed, the investor gains access to gold coins and bars.

Investing in precious metals can provide diversification and protection from inflation, geopolitical risks, and market volatility.

Charles Schwab provides guidance throughout the process, to help investors understand the implications and potential benefits of incorporating precious metals into their retirement strategy.

Individuals can access the potential benefits of investing in gold within their Individual Retirement Account. It is important to note that eligibility criteria may depend on the type of retirement account an investor holds. Always seek professional guidance when considering investment options.

Investing in Gold through Charles Schwab

No third parties or counterparty risks are involved. Plus, physical gold is accepted worldwide as a valuable commodity and form of currency, making it a favored choice for protecting wealth and preserving purchasing power.But, take caution when using your IRA. Early withdrawals will result in hefty penalties, putting your retirement dreams at risk.

Proactive Investment Management and Advisory Services provided by Schwab

Schwab stands apart in the industry with their personalized investment management services. They work with clients to understand their financial goals, risk tolerance, and investment preferences.

Continuous monitoring and portfolio analysis are a part of their services. This includes regular reviews of performance, asset allocation, and potential optimization opportunities. They also offer proactive rebalancing of portfolios to maintain target allocations.

Schwab provides ongoing education and support. They offer access to research tools, educational resources, and personalized guidance from knowledgeable advisors.

These proactive services give investors the confidence to navigate market complexities. Schwab’s expertise is a trusted partner for investors seeking guidance to reach their goals. Other companies may offer similar services, yet Schwab puts extra effort to provide comprehensive support.

Charles Schwab’s Gold IRA services have advantages. However, consider the limited alternative asset options, potential fees, and high minimums for certain accounts. Evaluate these factors based on individual investment goals and preferences before deciding. Wrap up your gold investment journey with Charles Schwab Gold IRA and secure your future with a glittering touch of financial stability.

Investing in Gold through Charles Schwab

Investing in gold through Charles Schwab offers the opportunity to access precious metals within your brokerage account. Discover the advantages of physical gold over paper gold, providing a tangible and secure investment option. With Charles Schwab, you can take advantage of the potential benefits that come with investing in this precious resource.

Access to Precious Metals in a Charles Schwab Brokerage Account

Secure gold with a Charles Schwab brokerage account. Diversify your portfolio and protect against economic uncertainties. By offering physical gold, Charles Schwab allows investors to add a tangible asset to their strategy.

Charles Schwab Final Thought

The Charles Schwab Gold IRA offers a range of services and investment options. Investors have the opportunity to invest in physical gold via a self-directed IRA, which gives them more control than traditional IRAs.

can easily access precious metals, such as gold, in their Charles Schwab brokerage accounts. This makes managing and tracking investments simpler. Physical gold is often preferred due to its tangible nature and its ability to act as a hedge against inflation and economic uncertainty.

When planning for retirement, it is important to consider IRA withdrawal rules and regulations. Early withdrawals may incur penalties. Also, required minimum distributions (RMDs) should be taken into account. Charles Schwab has rollover options into a precious metals IRA, so individuals can transfer existing retirement savings.

In summary, Charles Schwab Gold IRA offers a wide range of services and investment opportunities. Advantages include affordability and access to various financial products. Limitations and fees should also be taken into account. Comparing Charles Schwab’s offerings with other companies and taking advantage of their investment management and advisory services can enhance the investor’s experience.

Some Facts About Charles Schwab Gold Ira Review:

✅ Charles Schwab Corporation has been providing wealth and asset management, stockbroking, banking, custodial, and consulting services since 1971. (Source: Team Research)

✅ Schwab offers investment management, monitoring, and analysis services and earn brokerage commissions as the client’s broker. (Source: Team Research)

✅ While Schwab provides IRA services to investors with zero dollar deposits, they do not directly hold gold or precious metals. (Source: Team Research)

✅ Investors with Schwab cannot purchase physical gold coins or bars through the company, but they can access precious metals, including physical coins and bars, through a brokerage account. (Source: Team Research)

✅ A Schwab 401k can be rolled into a precious metals IRA, but this can only be done with a company specializing in these accounts. (Source: Team Research)

FAQs About Charles Schwab Gold Ira Review

What is a Charles Schwab Gold IRA?

A Charles Schwab Gold IRA refers to an individual retirement account offered by Charles Schwab Corporation that allows investors to hold precious metals, such as gold, silver, platinum, and palladium, as part of their retirement savings. However, it is important to note that Charles Schwab does not directly hold physical gold or precious metals, but investors can access these assets through a brokerage account.

What are the benefits of a Charles Schwab Gold IRA?

A Charles Schwab Gold IRA provides investors with the opportunity to include precious metals in their retirement portfolio, offering potential benefits such as diversification and the potential for future profit. Physical gold and other precious metals are considered safe haven commodities and can act as a hedge against economic dangers. Additionally, a self-directed IRA allows investors to have more control over their retirement plan and offers additional investment alternatives.

Can I purchase physical gold coins or bars through Charles Schwab?

No, Charles Schwab does not offer the ability to directly purchase physical gold coins or bars. However, investors can access precious metals, including physical coins and bars, through a brokerage account offered by Charles Schwab.

What are the potential risks associated with the Schwab U.S. Aggregate Bond Index Fund (SWAGX)?

The Schwab U.S. Aggregate Bond Index Fund (SWAGX) has an effective duration of 6.3 years, meaning that for every 1% increase in interest rates, the fund’s value is expected to decline by 6.3%. This means that if interest rates rise, there is a potential for price declines in the fund. However, SWAGX is still considered a suitable option for investors looking to add balance to a portfolio that is heavily focused on stock funds.

Does Charles Schwab offer check writing services for self-directed IRAs?

No, Charles Schwab does not offer check writing services for self-directed IRAs. However, they do provide a range of other services including investment management, traditional banking services, and customized investment advice.

What are the minimum account balances for a self-directed IRA with Charles Schwab?

The minimum account balance for a self-directed IRA with Charles Schwab is $25,000. It is important to note that certain accounts may have different minimum balance requirements.